zheniya.online

Learn

How Much Is A Alignment For A Car

That's what I thought (priced too high). The same dealer has done alignments for me in the $ range in the past but for a RWD car. Maybe they are just too. By the end of a wheel alignment appointment, your steering wheel will be perfectly centered so you can maneuver your car as expected. How Much Does Wheel. Wheel alignment costs average about $75 at most tire stores, depending on the vehicle and time involved. Most alignments take about one hour of. How much is a Toyota alignment? An alignment usually values anywhere between When should you get an alignment for your car? The resolution can vary. An alignment is the process of making sure all 4 wheels point in the same direction, which will cause the vehicle to drive straight and not drift. Performing. An alignment usually costs anywhere between $60 - $ depending on a lot factors such as location and parts availability. Alignment is the process of adjusting vehicle suspension components to bring the wheels and tires into specific angles, facilitating optimal vehicle handling. An alignment consists of adjusting the steering and suspension components of your vehicle that are connected to your vehicles wheels. If you have an all-wheel-drive or four-wheel-drive vehicle, you have to get a four-wheel alignment. On the other hand, certain trucks, SUVs and classic cars may. That's what I thought (priced too high). The same dealer has done alignments for me in the $ range in the past but for a RWD car. Maybe they are just too. By the end of a wheel alignment appointment, your steering wheel will be perfectly centered so you can maneuver your car as expected. How Much Does Wheel. Wheel alignment costs average about $75 at most tire stores, depending on the vehicle and time involved. Most alignments take about one hour of. How much is a Toyota alignment? An alignment usually values anywhere between When should you get an alignment for your car? The resolution can vary. An alignment is the process of making sure all 4 wheels point in the same direction, which will cause the vehicle to drive straight and not drift. Performing. An alignment usually costs anywhere between $60 - $ depending on a lot factors such as location and parts availability. Alignment is the process of adjusting vehicle suspension components to bring the wheels and tires into specific angles, facilitating optimal vehicle handling. An alignment consists of adjusting the steering and suspension components of your vehicle that are connected to your vehicles wheels. If you have an all-wheel-drive or four-wheel-drive vehicle, you have to get a four-wheel alignment. On the other hand, certain trucks, SUVs and classic cars may.

A car that pulls to one side or steers erratically, for example, probably has an alignment problem. Wheel alignment is a standard part of auto maintenance. We'll adjust the angle of your wheels, thereby keeping them consistent with the manufacturer's. Watch How Wheel Alignments Add to Your Safety. A properly aligned vehicle means extended tire life, better fuel economy and a safer ride. If anything seems. Wheel alignment is a service in which a mechanic first checks, or measures the positioning of a vehicles wheels against the vehicle manufactures recommended. The cost for this service can be as much as $ Four-wheel alignment: This is the most comprehensive type of wheel alignment. It's necessary for most modern. How much is a Nissan alignment? An alignment often rates anywhere between $60 - $ depending on various factors such as location and parts availability. How much does an alignment machine cost? If you are buying a brand-new alignment machine, expect costs that start at $10, and range to $34, · Who makes. The average cost for a Wheel Alignment is between $ and $ · Quality Car Repair. Fair Prices. · Wheel Alignment · Need a repair? Trust our RepairPal. How much do you charge for an alignment service? Email isn't the only way to learn about big deals and savings, new product launches, as well as Whiteline Events in your area. Wheel alignment, or tire alignment, is how the tires are angled onto the vehicle, maximizing contact with the road. Tire alignments impact the suspension. How much does a Discount Tire wheel alignment cost? ; Alignment Inspection FREE ; Alignment Service $ ; Electric Vehicle Alignment $ We'll check that your vehicle's alignment meets your manufacturer's specs for free. If you do need an alignment, our tire technicians will make front-end or. Regardless of whether they're 4WD, front-wheel-drive or rear-wheel-drive, most cars and many SUVs today are four-wheel alignable. These vehicles should get a. Many clients come in from all over the Lower Mainland and Greater Vancouver area for alignment and suspension service. We will cater to all cars, light & medium. An alignment is the process of making sure all 4 wheels point in the same direction, which will cause the vehicle to drive straight and not drift. How Much Does a Wheel Alignment Cost? · Type of Vehicle: The size and complexity of your vehicle play a significant role. · Location: Prices can also vary by. How much does wheel alignment cost? · $50 to $ align front or rear wheels · $ to $ align all four wheels. How long does a wheel alignment take? A standard wheel alignment typically takes around 1 to 2 hours to complete, depending on the vehicle and the complexity. Wheel Alignment – $ for Four Wheel Alignment · Wheel Alignment for half ton & up – Call · Vehicle Inspection – $ · Insurance Inspection – $

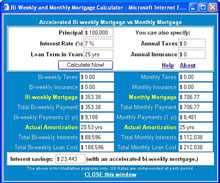

Bi Monthly Mortgage Payments Calculator

Biweekly savings are achieved by simply paying your monthly mortgage payment every two weeks and making 1 1/2 times your monthly mortgage payment every sixth. Use our bi-monthly loan payments calculator to find out how making bi-monthly payments on your home loan can reduce the length & overall cost of your loan. A biweekly mortgage is one on which the borrower makes a payment equal to half the monthly payment every two weeks. Bi-weekly payments accelerate your mortgage payoff by paying half of your normal monthly payment every two weeks. By the end of each year, you will have. Biweekly payments accelerate your mortgage payoff by paying 1/2 of your normal monthly payment every two weeks. By the end of each year, you will have paid the. Sometimes spelled as “bi-monthly” mortgage payments, these plans are mortgage lenders calculate interest as a monthly cost, not a bimonthly cost. This Bi-Weekly Mortgage Calculator makes the math easy. It will figure your interest savings and payoff period for a variety of payment scenarios. Use this calculator compare your bi-weekly mortgage payments to a monthly mortgage payment and how that may impact interest savings. This calculator shows how much you save if you make ½ of your mortgage payment every 2 weeks instead of making a full mortgage payment once a month. Biweekly savings are achieved by simply paying your monthly mortgage payment every two weeks and making 1 1/2 times your monthly mortgage payment every sixth. Use our bi-monthly loan payments calculator to find out how making bi-monthly payments on your home loan can reduce the length & overall cost of your loan. A biweekly mortgage is one on which the borrower makes a payment equal to half the monthly payment every two weeks. Bi-weekly payments accelerate your mortgage payoff by paying half of your normal monthly payment every two weeks. By the end of each year, you will have. Biweekly payments accelerate your mortgage payoff by paying 1/2 of your normal monthly payment every two weeks. By the end of each year, you will have paid the. Sometimes spelled as “bi-monthly” mortgage payments, these plans are mortgage lenders calculate interest as a monthly cost, not a bimonthly cost. This Bi-Weekly Mortgage Calculator makes the math easy. It will figure your interest savings and payoff period for a variety of payment scenarios. Use this calculator compare your bi-weekly mortgage payments to a monthly mortgage payment and how that may impact interest savings. This calculator shows how much you save if you make ½ of your mortgage payment every 2 weeks instead of making a full mortgage payment once a month.

Bi-Weekly Vs. Monthly Loan Calculator This calculator will help you to compare the costs between a loan that is paid off on a bi-weekly payment basis and a. Trying to save money? Determine how much money you can save by switching from monthly mortgage payments to a bi-weekly schedule. Biweekly savings are achieved by simply paying your monthly mortgage payment every two weeks and making 1 1/2 times your monthly mortgage payment every sixth. The tool calculates an accelerated biweekly payment, for example, by taking your normal monthly payment and dividing it by two. Since you would pay 26 biweekly. The tool calculates an accelerated biweekly payment, for example, by taking your normal monthly payment and dividing it by two. Since you would pay 26 biweekly. This calculator shows you possible savings by using an accelerated biweekly mortgage payment. Biweekly payments accelerate your mortgage payoff. Use our biweekly payment calculator to see how you could save on mortgage interest and pay off your mortgage faster with biweekly payments. Our free biweekly payment calculator can help you discover your potential interest savings as well as how early you could pay the entire loan off. Try it now. Compared to biweekly payments, you'll pay more interest over the life of your home loan. This is true regardless of whether your mortgage rate is low, fixed or. Our bi-weekly vs monthly mortgage payment calculator will show you the mortgage interest savings over the life of your mortgage. Use this calculator to determine your payment or loan amount for different payment frequencies. You can make payments weekly, biweekly, semimonthly, monthly. This calculator will help you compare the costs of a loan with a biweekly payment schedule and a loan with a monthly payment schedule. The biweekly mortgage calculator will help you decide if making biweekly mortgage payments is right for you. Other Calculators: Affordability Calculator. For example, the accelerated bi-weekly payment allows you to pay half of your monthly payment every two weeks. You will therefore make 26 payments a year, the. The accelerated weekly payment is calculated by dividing your monthly payment by four. You then make 52 weekly payments. Just like the accelerated bi-weekly. This calculator will show you how much you will save if you make 1/2 of your mortgage payment every two weeks instead of making a full mortgage payment once a. This bi-weekly payment calculator is designed to help you determine how much you can save on your existing mortgage by switching to a bi-weekly payment. We calculate an accelerated biweekly payment, for example, by taking your normal monthly payment and dividing it by two. Since you would pay 26 biweekly. Bimonthly Loan Calculator - Find repayment and interest amount with full amortization schedule for loans with bimonthly payments. Our free biweekly payment calculator can help you discover your potential interest savings as well as how early you could pay the entire loan off.

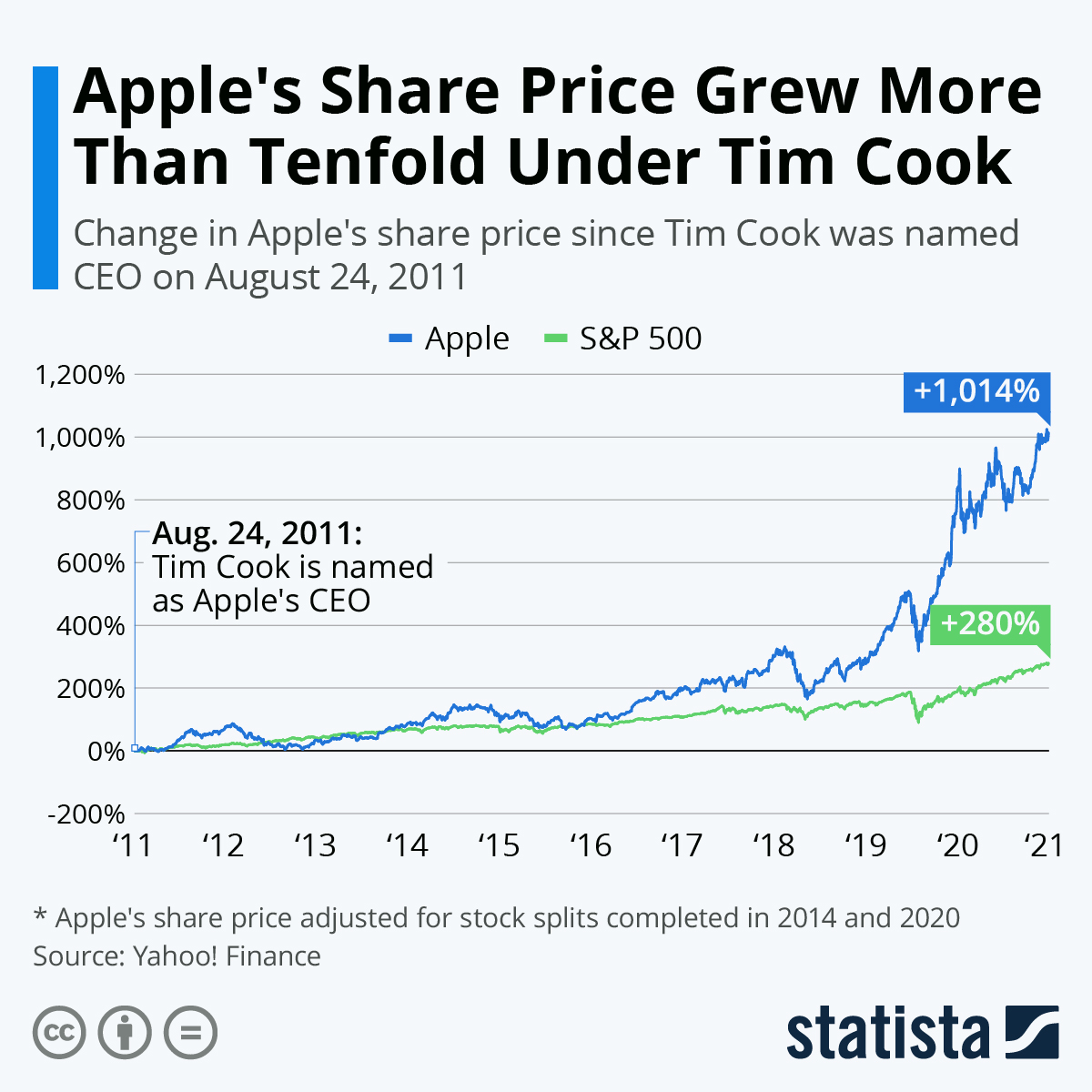

Cost To Buy Apple Stock

Discover real-time Apple Inc. Common Stock (AAPL) stock prices, quotes, historical data, news, and Insights for informed trading and investment decisions. Apple's current share price divided by its per-share earnings (EPS) over a month period gives a "trailing price/earnings ratio" of roughly 34x. In other. AAPL | Complete Apple Inc. stock news by MarketWatch. View real-time stock prices and stock quotes for a full financial overview. The latest closing stock price for Apple as of September 05, is · The all-time high Apple stock closing price was on July 16, · The. Buying or selling a stock that's not traded in your local currency? Don't let the currency conversion trip you up. Convert Apple Inc stocks or shares into any. We raised our fair value estimate for shares of wide-moat Apple to $ from $ after raising our medium-term iPhone revenue forecast. Estimated Cost. $ How to buy Apple? Sign up for a Robinhood brokerage account to buy or sell Apple stock and options commission-free. Other fees may apply. Invest in Apple, NASDAQ: AAPL Stock - View real-time AAPL price charts. Online commission-free investing in Apple: buy or sell Apple Stock commission-free. The Apple Inc stock price today is What Is the Stock Symbol for Apple Inc? The stock ticker symbol for Apple Inc is AAPL. Is AAPL the Same as $AAPL? Discover real-time Apple Inc. Common Stock (AAPL) stock prices, quotes, historical data, news, and Insights for informed trading and investment decisions. Apple's current share price divided by its per-share earnings (EPS) over a month period gives a "trailing price/earnings ratio" of roughly 34x. In other. AAPL | Complete Apple Inc. stock news by MarketWatch. View real-time stock prices and stock quotes for a full financial overview. The latest closing stock price for Apple as of September 05, is · The all-time high Apple stock closing price was on July 16, · The. Buying or selling a stock that's not traded in your local currency? Don't let the currency conversion trip you up. Convert Apple Inc stocks or shares into any. We raised our fair value estimate for shares of wide-moat Apple to $ from $ after raising our medium-term iPhone revenue forecast. Estimated Cost. $ How to buy Apple? Sign up for a Robinhood brokerage account to buy or sell Apple stock and options commission-free. Other fees may apply. Invest in Apple, NASDAQ: AAPL Stock - View real-time AAPL price charts. Online commission-free investing in Apple: buy or sell Apple Stock commission-free. The Apple Inc stock price today is What Is the Stock Symbol for Apple Inc? The stock ticker symbol for Apple Inc is AAPL. Is AAPL the Same as $AAPL?

The price of a security measures the cost to purchase 1 share of a security. For a company, price can be multiplied by shares outstanding to find the market. The current price of AAPL is USD — it has decreased by −% in the past 24 hours. Watch Apple Inc stock price performance more closely on the chart. Apple Inc. AAPL (U.S.: Nasdaq). AT CLOSE PM EDT 09/06/ $USD; %. Volume48,, AFTER HOURS PM EDT 09/06/ Analyst Rating / Earnings Estimates. Current Rating. See More. Moderate Buy. Based on 31 analysts offering recommendations. The 99 analysts offering price forecasts for Apple have a median target of , with a high estimate of and a low estimate of News & Analysis · % of Warren Buffett's $ Billion Berkshire Hathaway Portfolio Is in These 2 Dividend Stocks · Apple Stock: Buy, Sell, or Hold? · Warren. “Secondary support is approximately $” Stockton isn't making a fundamental call on Apple's artificial intelligence initiatives or sales of the new iPhone. Apple Inc. ; Price Momentum. AAPL is trading near the top ; Price change. The price of AAPL shares has decreased $ ; Closed at $ The stock has since. And erase the idea that Cook permanently did anything to the stock value. As you know, stock prices fluctuate. Can I Buy Apple Inc Shares in India? Yes, Apple Inc shares can be bought in · By being transparent about fees and charges involved while investing in a. Get Apple Inc (AAPL:NASDAQ) real-time stock quotes, news, price and financial information from CNBC. The average price target is $ with a high forecast of $ and a low forecast of $ The average price target represents a % change from the. shares of Apple at the IPO would have cost you $ There have been subsequent stock splits that make each original share now 56 shares. Back when Apple launched its IPO in December , you could purchase a single share for US$ Today, its value is over US$ after several stock splits. With. Real-time Price Updates for Apple Inc (AAPL-Q), along with buy or sell indicators, analysis, charts, historical performance, news and more. A market order is an order to buy or sell a stock or other asset at the market's current available price. Once you complete the order page, click the "Place. Apple stock is a buy at current levels, Wall Street mostly thinks so. Of the 45 analysts covering AAPL surveyed by S&P Global Market Intelligence, 24 rate. To buy AAPL shares in Australia, you'll need to open an account with an investing platform that offers the security. Try Stake, you can sign up in minutes. Fund. Right now i WISH I had Apple at prices and im actively buying more. What's the one stock you're immediately buying if it trades at 50%. View Apple Inc. AAPL stock quote prices, financial information, real Buy Rating Affirmed for Apple as iPhone 16 and New AI Set to Boost Demand.

Should I Set Up A Donor Advised Fund

Donor-advised funds simplify charitable giving and are increasingly popular. Learn how to make the most of this philanthropic opportunity with this guide. A donor advised fund may be established through a bequest, naming your children or others to be the fund advisors. Contact us. To learn more about establishing. Contributions via DAFs help donors maximize tax benefits. Donors can contribute immediately, build a philanthropic strategy and recommend grants when ready. Their simplicity to set-up, flexibility, and tax-saving capabilities have proven to be an excellent tool in charitable and estate planning as well as business. You can claim a tax write-off in the year you make your contributions rather than when you choose to send those contributions to charity. This could help reduce. They can also set up an account called a donor-advised fund (DAF). According Donor-Advised Funds Growing Ever Faster: How Should Nonprofits Access the Wealth? A DAF allows time for a donor to develop a philanthropic vision. Donors can make contributions to their fund, receive an immediate tax deduction and make grants. Because the Trust is set up as a tax-exempt organization and a public charity,3 contributions of appreciated securities to a Donor-Advised Fund of the Trust are. This makes a donor-advised fund a powerful option for anyone experiencing a high-income year or windfall, or someone in their prime earning years with little. Donor-advised funds simplify charitable giving and are increasingly popular. Learn how to make the most of this philanthropic opportunity with this guide. A donor advised fund may be established through a bequest, naming your children or others to be the fund advisors. Contact us. To learn more about establishing. Contributions via DAFs help donors maximize tax benefits. Donors can contribute immediately, build a philanthropic strategy and recommend grants when ready. Their simplicity to set-up, flexibility, and tax-saving capabilities have proven to be an excellent tool in charitable and estate planning as well as business. You can claim a tax write-off in the year you make your contributions rather than when you choose to send those contributions to charity. This could help reduce. They can also set up an account called a donor-advised fund (DAF). According Donor-Advised Funds Growing Ever Faster: How Should Nonprofits Access the Wealth? A DAF allows time for a donor to develop a philanthropic vision. Donors can make contributions to their fund, receive an immediate tax deduction and make grants. Because the Trust is set up as a tax-exempt organization and a public charity,3 contributions of appreciated securities to a Donor-Advised Fund of the Trust are. This makes a donor-advised fund a powerful option for anyone experiencing a high-income year or windfall, or someone in their prime earning years with little.

Creating a donor-advised fund can provide you with immediate tax benefits while making your charitable giving easier for years to come. How It Works: You. A donor-advised fund, sometimes referred to as a “DAF,” is a charitable giving vehicle sponsored by a public charity, like the Greater Kansas City Community. With some planning and initial paperwork, you can establish a DAF to start tax-smart charitable giving. It takes some effort upfront, but the ongoing. To facilitate charitable giving in your family, consider establishing a donor-advised fund, often referred to as a DAF. The main benefit of a DAF is the ability to make a donation and take an immediate tax deduction for it while waiting to decide how the donation should actually. Ability to make or fund a pledge. Donor-advised fund Both Private Donors should consult their tax advisors for more information. (ZDF1). Benefits of donor-advised funds · 1. Tax savings. Donors can take a tax deduction for their contribution in the year they make the deposit into their DAF, even. Whether you plan to donate cash or securities, establishing automatic contributions rather than a lump-sum donation will regularly increase the amount available. A donor-advised fund is a charitable giving option where donors make irrevocable gifts directly to a sponsoring charity (public charity) that maintains their. Know that your charitable dollars are wisely invested and grow tax-free, allowing more nonprofits to continue to benefit from your generosity. Start A Fund. We. You just set up an account with Schwab Charitable and contribute cash, securities, or appreciated assets. You'll be eligible for a current-year tax deduction. Because DAFs make it more convenient to give and allow many donors to claim larger tax benefits, they reduce both the hassle of giving and donors' out-of-pocket. A donor-advised fund (DAF) is simple to set up and maintain, and can help you plan for giving throughout your lifetime and beyond. · When you contribute to a DAF. Donor advised funds (DAFs) have become a popular way of supporting charities while exercising more control and input than is available with an outright gift. A DAF is an account that allows someone to make a donation, get an immediate tax benefit, and choose the organization that money goes to at a later date. A Donor Advised Fund is a flexible charitable giving tool used by individuals, families, foundations, corporations, and nonprofit organizations. A donor-advised fund allows you to streamline your charitable giving. Your fund will be invested with the potential to grow over time. Bank of America's online. Make an irrevocable, tax-deductible contribution to your donor-advised fund · Initial contribution minimum is $25, · You can contribute a wide variety of. Support a charity you believe in through strategic giving, over time. · Maintain family involvement in charitable decisions. · Create a lasting legacy. · Take. Receive a charitable tax deduction when you make a contribution to a DAF and make decisions about which charities to support at a later date. Setting aside.

Gator Guard Garage Floor Coating Reviews

GatorGuard Concrete Coatings provides the highest possible Epoxy & Polyspartic/Polyurea flooring on the market. We specialize in transforming the floor in. Here we go again. We've all been here. We know what's gonna happen to this oil. Gatorguard Concrete Coatings. A lot of customers ask how easy it is to clean up. July 13, Gatorguard at my house to schedule epoxy coating on garage floor. deposit of $ zheniya.online floor was sunk in places @ " with large. We noticed that the majority of users who reviewed this penetrating concrete sealer recommended it to others, citing that it was easy to apply, dried on color-. 5X stronger than 1-part epoxy · Walk on in days and drive on in 3 days · Glossy finish · Durable protection with no peel promise · Indoor use only · Low odor and. You will not be disappointed in the quality of work or the superiority of the product over Epoxy. And you will have a beautiful new floor that will only take. customer reviews of GatorGuard Concrete Coatings. One of the best Flooring businesses at Farmington Road, Livonia, MI United States. GatorGuard has disrupted the industrial flooring segment by prioritizing quality over speed. Unlike traditional coatings that are fast but often subpar, its. I put rock solid on my garage. I definitely do not regret it because everything sits on top of the epoxy (oil, etc.). It is very easy to clean. GatorGuard Concrete Coatings provides the highest possible Epoxy & Polyspartic/Polyurea flooring on the market. We specialize in transforming the floor in. Here we go again. We've all been here. We know what's gonna happen to this oil. Gatorguard Concrete Coatings. A lot of customers ask how easy it is to clean up. July 13, Gatorguard at my house to schedule epoxy coating on garage floor. deposit of $ zheniya.online floor was sunk in places @ " with large. We noticed that the majority of users who reviewed this penetrating concrete sealer recommended it to others, citing that it was easy to apply, dried on color-. 5X stronger than 1-part epoxy · Walk on in days and drive on in 3 days · Glossy finish · Durable protection with no peel promise · Indoor use only · Low odor and. You will not be disappointed in the quality of work or the superiority of the product over Epoxy. And you will have a beautiful new floor that will only take. customer reviews of GatorGuard Concrete Coatings. One of the best Flooring businesses at Farmington Road, Livonia, MI United States. GatorGuard has disrupted the industrial flooring segment by prioritizing quality over speed. Unlike traditional coatings that are fast but often subpar, its. I put rock solid on my garage. I definitely do not regret it because everything sits on top of the epoxy (oil, etc.). It is very easy to clean.

Polyurea is our best choice for customers who want an incredibly high gloss, beautiful garage floor with outstanding chemical and abrasion resistance. If Justin. "They did a nice job on the floor although they talked me out of getting a finish clear coat. Without the clear coat the epoxy coating is easily scuffed and I'. Used this product with the Rust-oleum garage floor paint and the outcome is fantastic on my workshop floor. Instructions are easy to follow and the product is a. A polyaspartic coating provides great floor protection, is easy to clean and maintain, and enhances a garage's décor. 2. Epoxy floor coating. If you're thinking. Install was good. Life time guarantee is worthless. They want to charge $ to come out to see if guarantee is covered. Description of Work: Epoxy garage. GatorGuards impenetrable coating stopping costly salt and water intrusion damage. Our customized garage floor coatings Reviews for GatorGuard of Cincinnati. Patched the gouges with epoxy, got everything smooth and then added this keel guard. Used my automotive lift to support the boat while I worked underneath. May be an image of text that says 'G GatorGuard Gator Guard Concrete Coatings Grant GatorGuard Concrete Coatings - Reviews - Flooring in. Garage, Shop or Factory Floor ;. Basement, Enclosed Space ;. Patio, Walk, Drive or. Pool-Deck ;. Home Office Interior. Buy Dominion Sure Seal Gator Guard II BGG2 Black Epoxy Bedliner ( Gallon) at zheniya.online As an experienced, family-owned concrete coating contractor, GatorGuard is the company to call for epoxy coatings that provide the ultimate in protection. BBB accredited since 11/3/ Floor Coverings in Indianapolis, IN. See BBB rating, reviews, complaints, get a quote & more GatorGuard Garage Floor Coating. GatorGuard is your source for your floor coating needs. We handle indoor surfaces and apply epoxy coatings to garages as well as other surfaces. GatorGuard is the premier floor coating company in the Midwest offering Lifetime warranties! Experienced Epoxy Flooring Installer. Indianapolis, IN. $ GATOR GRIP incorporates a chemical curing mechanism that achieves fast initial water resistance and curing, and continues to harden and cure for days after. It's held up really well over the last 2 years. It was a pain to do though as the concrete was in really bad condition so I rented a diamabrush. Works great on workshop floors, garage floors and other interior concrete surfaces. Low VOC's and a low odor make it a great choice for indoor applications. Insl-X GarageGuard Semi-Gloss Gray Water-Based Waterborne Epoxy Garage Floor Coating Kit 1 ga - Case of: 1. Free day returns. + Five Star Reviews! I would highly recommend Croc Coating. Adam's crew was on time and extremely professional. We had our outdoor patio covered, and our. Worked great at 75psi. Everything cleans up well with acetone. The A part of this epoxy is a thick sludge. Tis makes mixing an interesting and potentialy messy.

Financial Literates

Global Financial Literacy Excellence Center (GFLEC) has positioned itself to be the world's leading center for financial literacy research and policy. Financial literacy for employees · 1. Survey employees to learn about their financial concerns · 2. Offer targeted guidance for a financially diverse workforce. Financial literacy is the cognitive understanding of financial components and skills such as budgeting, investing, borrowing, taxation, and personal financial. The Division offers free online financial education programs for various audiences, including the military, persons with developmental disabilities and more. We want financial literacy to be a part of your life. We are focused on providing educational support and resources on financial understanding. We will focus on. The Commission sets strategic direction for policy, education, practice, research, and coordination so that all Americans make informed financial decisions. Financial literacy is the ability to make wise decisions with your money. The five principles of financial literacy are earning, saving, borrowing, spending and. Benefits of Financial Literacy · Ability to make better financial decisions · Effective management of money and debt · Greater equipped to reach financial goals. Financial Literacy · Building a budget · Unit pricing · Emergency fund · Saving wisely: planned expenses · Paying yourself first · Budgeting and saving: Quiz 1. Global Financial Literacy Excellence Center (GFLEC) has positioned itself to be the world's leading center for financial literacy research and policy. Financial literacy for employees · 1. Survey employees to learn about their financial concerns · 2. Offer targeted guidance for a financially diverse workforce. Financial literacy is the cognitive understanding of financial components and skills such as budgeting, investing, borrowing, taxation, and personal financial. The Division offers free online financial education programs for various audiences, including the military, persons with developmental disabilities and more. We want financial literacy to be a part of your life. We are focused on providing educational support and resources on financial understanding. We will focus on. The Commission sets strategic direction for policy, education, practice, research, and coordination so that all Americans make informed financial decisions. Financial literacy is the ability to make wise decisions with your money. The five principles of financial literacy are earning, saving, borrowing, spending and. Benefits of Financial Literacy · Ability to make better financial decisions · Effective management of money and debt · Greater equipped to reach financial goals. Financial Literacy · Building a budget · Unit pricing · Emergency fund · Saving wisely: planned expenses · Paying yourself first · Budgeting and saving: Quiz 1.

Financial Literacy · Budgeting · Debt management · Paying for school (with or without loans) · Saving and investing · Credit cards and credit scores · Finding a. Comprehensive, Digital Financial Literacy. EVERFI's free lesson library offers financial education curriculums for students in grades 4 through Each program. Gain financial literacy with Apex Learning Virtual School. Our online course equips you with essential money management skills for a successful future. 25% of workers decreased the amount they were saving for retirement in because of inflation's impact on their finances; almost 1/2 of these (12%) stopped. Financial literacy empowers all of us to make smart decisions – how to budget, save, borrow, and invest. To afford our daily lives, plan our financial futures. Global Financial Literacy Excellence Center (GFLEC) has positioned itself to be the world's leading center for financial literacy research and policy. One of the enormous benefits kids and adults can gain from understanding financial literacy is knowing the value of money. Teaching kids their money's worth. Financial literacy education provides students the tools and skills necessary to make informed financial decisions, particularly in regards to the student loan. “Financial literacy” is designed to make talking about money easier. It is organized by three key phases people go through when managing their wealth. What Is Financial Literacy? Financial literacy is the ability to understand and effectively use various financial skills, including personal financial. This directory provides information on financial literacy resources, issues and events that are important to bankers, organizations, and consumers of. What Is Financial Literacy? Financial literacy is the ability to understand and effectively use various financial skills, including personal financial. We want financial literacy to be a part of your life. We are focused on providing educational support and resources on financial understanding. We will focus on. Financial literacy is vital for personal prosperity, economic stability, and informed decision-making. It empowers individuals to manage their finances. A space to discover a wide range of money skills to increase your money knowledge and make confident financial decisions. Financial literacy empowers all of us to make smart decisions – how to budget, save, borrow, and invest. To afford our daily lives, plan our financial futures. High School. This guide focuses on financial literacy for high school students and spans 18 weeks (1 semester) and is divided into 3-week-long units covering. Adult Program · The Financial Literacy Program run by FIS can help alleviate this stress by providing real-life examples on how to wisely manage your money. Intuit for Education will change the way we teach financial literacy. Intuit for Education is a free and flexible financial literacy platform for high school. Here are six ways to help improve your financial literacy skills to help you achieve your short- and long-term goals.

New Money Bonus

Here's how to earn your $ checking account bonus. Have direct deposits totaling $ or more put into your new checking account within 90 days of opening. If you are in the market for a new savings or checking account, signing up for one with a bonus promotion is a great way to earn a little extra cash for your. If you open a new Chase Savings account and deposit $15, in new money within 30 days and maintain a $15, balance for 90 days, you'll earn a $ bonus. To qualify for the $ cash bonus you are required to open a new Priority Platinum Checking account and have qualifying direct deposit(s) totaling $ per. 3 Steps to a Cash Bonus · OPEN Open a new checking and enter promo code: bonus · DEPOSIT Set up direct deposits of at least $1, or more within the first You can receive only one new checking account opening related bonus every two years from the last coupon enrollment date and only one bonus per account. SoFi offers up to a $ bonus for any new customer opening a Better Online Bank Account who can put at least $5, of direct deposits into the account within. Open a new eligible Bank of America business checking account and qualify for a $ cash bonus offer Access to powerful digital tools and Small Business. Enjoy the bonus. Maintain your new money for 90 days from coupon enrollment — we'll add the bonus into your account within 40 days. Eligible and ineligible. Here's how to earn your $ checking account bonus. Have direct deposits totaling $ or more put into your new checking account within 90 days of opening. If you are in the market for a new savings or checking account, signing up for one with a bonus promotion is a great way to earn a little extra cash for your. If you open a new Chase Savings account and deposit $15, in new money within 30 days and maintain a $15, balance for 90 days, you'll earn a $ bonus. To qualify for the $ cash bonus you are required to open a new Priority Platinum Checking account and have qualifying direct deposit(s) totaling $ per. 3 Steps to a Cash Bonus · OPEN Open a new checking and enter promo code: bonus · DEPOSIT Set up direct deposits of at least $1, or more within the first You can receive only one new checking account opening related bonus every two years from the last coupon enrollment date and only one bonus per account. SoFi offers up to a $ bonus for any new customer opening a Better Online Bank Account who can put at least $5, of direct deposits into the account within. Open a new eligible Bank of America business checking account and qualify for a $ cash bonus offer Access to powerful digital tools and Small Business. Enjoy the bonus. Maintain your new money for 90 days from coupon enrollment — we'll add the bonus into your account within 40 days. Eligible and ineligible.

New checking & savings customers can earn up to $ with qualifying activity. For new Customers only. Offer ends October 31, To receive the additional $ bonus: Open one of the above checking accounts AND open a Clearview Savings OR Money Market OR a Certificate with a 12 month or. 3 Bonus will be earned when a single deposit of $15, or more of new New money is defined as money not currently on deposit with Blue Foundry Bank. Earn up to a $ cash bonus when you open a new SoFi Checking and Savings account online with direct deposit. Take advantage of this promotion today! To earn a $2, cash bonus, add $, or more in new money to deposit and eligible investment accounts within the first 20 days of account opening, and. Most of the time, it's in the form of a cash bonus that the bank puts directly into your new account. Less commonly, the bonus payment might be handed out in. *To qualify for the $ cash bonus, open a new FirstView or SmartView Checking account by 09/15/ Client must be a new or existing First Horizon Bank. You can earn a cash bonus for opening either a personal checking account or a new business checking account after completing qualifying activities. U.S. Bank. Earning a new account bonus is easy. Use our tool to compare, filter and find the best bank promotions available right now. ***To receive the additional $ Savings bonus: 1) New checking account must be opened on the same day as the Savings, MM, or CD. 2) All checking bonus. In order to qualify for a one-time Balance Build Offer cash credit you must deposit a minimum total deposit of $5, of “new money” into your Checking account. Get a $ cash bonus when you open a new Relationship Checking account and have a cumulative total of $7, in qualifying direct deposits within 90 days of. Deposit $5, to earn a $ bonus, or $30, for an $ bonus, within 30 days: The deposits must be of money that is new to U.S. Bank; money transferred. The promo code is required at account opening to qualify for the bonus. Your new personal M&T checking account must still be open when we seek to credit the. Associated Bank: With a new checking account, you can receive a cash bonus of $, $ or $ if you maintain an average daily balance of $1, to $4, Member FDIC. Enjoy a $ bonus when you open a new Everyday checking account with qualifying electronic deposits. Banks regularly offer cash bonuses and other promotions to attract new customers. You can earn hundreds — and sometimes thousands — of dollars just by. After you have completed the requirements outlined within, we'll deposit the bonus in your new account on or before days of account opening. To receive the. The $ checking bonus does not require any additional activities. The cash bonus will be deposited into your new account within 10 business days of completing. Rewards Checking bonus up to $ You must be approved for your new Rewards Checking account and fund it within 60 days of account opening. An incentive of up.

Boa Voided Check

A voided check is often required when setting up electronic financial transactions. Learn how to void a check and how voided checks are used. In the Found app Tap "Business Account" at the top of the Banking screen. Navigate to "Documents" on the Business Account screen. Tap “Get a voided check” and/. Set up direct deposit and have your paycheck or other recurring deposits sent right to your checking or savings account — automatically. To begin, select the applicable account type (Checking or Savings) by marking the appropriate check box then, enter the state in which the account was opened in. Using Online Banking or Mobile Banking, you can access your Bank of America checking, savings accounts, CD, IRA, credit card, mortgage and line of credit. Why do some employers insist on a voided check or direct deposit form from my bank for direct deposit, especially since the direct deposit form. Find information on rates and fees for your Bank of America accounts. Learn about monthly maintenance fees, ways to help avoid overdraft fees, and more. By far the simplest way to get both numbers is to look on a paper check. Voided check Bank of America uses different Routing Numbers for their E-Check. Note: Funds can be deposited into one account or split between accounts as a set percent or dollar amount. Account type. Checking Savings. State Acct Opened. A voided check is often required when setting up electronic financial transactions. Learn how to void a check and how voided checks are used. In the Found app Tap "Business Account" at the top of the Banking screen. Navigate to "Documents" on the Business Account screen. Tap “Get a voided check” and/. Set up direct deposit and have your paycheck or other recurring deposits sent right to your checking or savings account — automatically. To begin, select the applicable account type (Checking or Savings) by marking the appropriate check box then, enter the state in which the account was opened in. Using Online Banking or Mobile Banking, you can access your Bank of America checking, savings accounts, CD, IRA, credit card, mortgage and line of credit. Why do some employers insist on a voided check or direct deposit form from my bank for direct deposit, especially since the direct deposit form. Find information on rates and fees for your Bank of America accounts. Learn about monthly maintenance fees, ways to help avoid overdraft fees, and more. By far the simplest way to get both numbers is to look on a paper check. Voided check Bank of America uses different Routing Numbers for their E-Check. Note: Funds can be deposited into one account or split between accounts as a set percent or dollar amount. Account type. Checking Savings. State Acct Opened.

Getting paid through direct deposit is easy and convenient. If you're considering opening a Bank of America (BoA) account to receive your salary, check out. Need a voided check or a signed bank letter for your Found account? You can have these sent to your email as PDFs. notice of the conversion and return the voided check to you. You should treat the voided check with care because someone else who obtains possession of it. (Notice for Former Bank of America EPiC Cardholders: All EPiC cards have been deactivated. If you had any remaining funds on your card, a paper check for the. Edit, sign, and share bank of america voided check pdf online. No need to install software, just go to DocHub, and sign up instantly and for free. Merchant services providers require that you offer a bank letter or voided check in order to approve a merchant account. Bank of America: 1 () You can find images of your written checks in digital banking. Mobile check deposits are only available using the U.S. Bank Mobile App. To find your mobile. Check Image. Account Number: Check #1. Check #6. (Or back of Check #1). Amount: Amount: Check #2. Check #7. (Or back of check #2). a minimum of 25 voided checks, and deposit tickets per depositing location to: To Be Completed by Customer. Bank of America Account Representative. To begin, select the applicable account type (Checking or Savings) by marking the appropriate check box then, enter the state in which the account was opened in. Can I request a stop payment on a check? Yes. You can request a stop payment on a check by signing in to Online Banking and selecting the Informations &. You can set up one-time payments, schedule future payments or create recurring payments from your checking, money market savings account, SafeBalance Banking®. Get answers to commonly asked questions about Bank of America financial centers. Get information on notary services, cashier's checks, and other services. notice of the conversion and return the voided check to you. You should treat the voided check with care because someone else who obtains possession of it. Complete the enrollment information form below and submit it to your payer/employer with a voided check from your CMA account Bank of America Corporation (“. How do I get a voided check from the Bank of America? if you're a customer and need a copy of a paid item, call them or order from the. This form takes the place of a Bank of America voided check. Give the direct boa direct deposit authorization form. bank of america direct deposit. M posts. Discover videos related to How to Get A Voided Check Online Boa on TikTok. See more videos about Best Restaurants in New Caney Tx. On-demand voided check generator. Compatible with 5,+ banks and credit unions across the US. CHASE Bank Logo BANK OF AMERICA Bank. For example, when you write a check at a retail store, the clerk might scan the information from the check, stamp your check "void" and hand it back to you.

How Should I Build My Credit

Paying your bills on time is the most important rule of thumb when it comes to generating good credit. Your payment history accounts for 35% of your total. The best practice is to pay your credit card bills in full every month. If you can't, pay as much as possible. Try to keep your credit utilization rate below. Get a student credit card, the Discover it Student Cashback card or Capital One equivalent is a good place to start. You might need to opt for a. Simply having an open credit card account is the easiest way to build credit, and payment history is the biggest ingredient in your credit score. With that. Pay your credit card bills on time - This will help you build a solid credit history and avoid high interest charges. Limit yourself to one or two cards - It. You might not have to apply for a secured credit card to start building credit. Several “starter” cards are available that let you build your credit history. One of the fastest ways to build good credit is by paying your bills on time. Creditors like to see a solid track record of responsibility. The higher your credit score, the lower interest rates you'll qualify for. Low interest rates can save you hundreds or thousands of dollars on personal loans. Increasing your credit limit will lower your credit utilization. The best way to do this is to ask your current lender for an increase. They already have access. Paying your bills on time is the most important rule of thumb when it comes to generating good credit. Your payment history accounts for 35% of your total. The best practice is to pay your credit card bills in full every month. If you can't, pay as much as possible. Try to keep your credit utilization rate below. Get a student credit card, the Discover it Student Cashback card or Capital One equivalent is a good place to start. You might need to opt for a. Simply having an open credit card account is the easiest way to build credit, and payment history is the biggest ingredient in your credit score. With that. Pay your credit card bills on time - This will help you build a solid credit history and avoid high interest charges. Limit yourself to one or two cards - It. You might not have to apply for a secured credit card to start building credit. Several “starter” cards are available that let you build your credit history. One of the fastest ways to build good credit is by paying your bills on time. Creditors like to see a solid track record of responsibility. The higher your credit score, the lower interest rates you'll qualify for. Low interest rates can save you hundreds or thousands of dollars on personal loans. Increasing your credit limit will lower your credit utilization. The best way to do this is to ask your current lender for an increase. They already have access.

Step users can build credit history for up to two years before turning We do not have control over your credit scores generated by the credit bureaus. Even. Apply for a credit card Used wisely, credit cards can speed up the process of building your credit. If you don't have enough credit history to get a regular . How to help improve your credit score · Open accounts that report to the credit bureaus. · Pay your credit card or loan bills on time and in full, every month. 1. Never miss a bill due date. Paying your bills on time is the cardinal rule of maintaining a good credit score. Review your credit report · Create a plan · Consider a debt consolidation loan or balance transfers to a lower rate credit card · Research working with a credit. How can I build my credit score? · Coaching. The 'Coaching' section has a plan called 'Build' that can help you build your credit report and score if you're new. 1. Get a Student Credit Card · 2. Sign Up for a Secured Credit Card · 3. Take Out (and Pay Back) a Credit Builder Loan · 4. Find a Co-Signer. Factors that contribute to a higher credit score include a history of on-time payments, low balances on your credit cards, a mix of different credit card and. Establishing credit from scratch takes at least six months, but using that time wisely can help you build a strong foundation for your credit future. Make sure the credit company reports your payment history so it will improve your credit rating. Interest rates on secured cards tend to be higher than other. How to build credit fast · 1. Pay credit card balances strategically · 2. Ask for higher credit limits · 3. Become an authorized user · 4. Pay bills on time · 5. The best way to build credit with a credit card is to use the card responsibly. This means paying your bill on time, every time, and only spending a small. Factors that contribute to a higher credit score include a history of on-time payments, low balances on your credit cards, a mix of different credit card and. Payment history accounts for just over a third of your credit score. Credit scorer FICO recommends that you always pay your bills on time to avoid late fees and. Why Do You Need Good Credit? Good use of credit will improve your credit score and that will provide many financial advantages in today's economy. Credit. Open a secured credit card. If you are unable to get approved for a traditional credit card, a secured credit card can help you build your credit history. This. How do you improve your credit score? · Review your credit reports. · Pay on time. · Keep your credit utilization rate low. · Limit applying for new accounts. · Keep. 10 keys to building good credit · Be patient with yourself. · Choose a good financial institution. · Start small and then expand. · Use your credit card responsibly. Paying your debts on time, maintaining a mix of different types of accounts and keeping your balances low can all help ensure that the credit history you. 1. Understand the basics of credit · 2. Become an authorized user on a parent's credit card · 3. Get a starter credit card · 4. Build credit by making payments on.